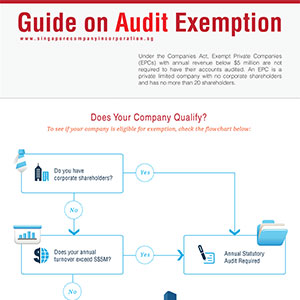

A Singapore Exempt Private Company or EPC* is a private limited company with 20 or fewer shareholders, none of which should be corporate entities. Such EPCs, with annual revenue below S$5 million, and dormant companies are exempted from having their accounts audited, and can just do unaudited financial statements, commonly known as director’s reports. But if the EPC’s annual turnover exceeds S$5 million, an annual statutory audit is mandatory.

Read More » New Audit Exemption Criteria for Small Companies

* An Singapore Exempt Private Company (EPC) has:

- 20 or fewer shareholders

- shares are not held by any corporate entity

Small exempt private companies (EPC) and dormant companies are exempted from having their accounts audited.

Need help with your Unaudited Report?

We are constantly kept abreast of Singapore’s regulatory compliance requirements. Engage our compliance specialists today to fulfil your business needs.