In this comparative report, we look at the differences between doing business in Singapore and China.

This report refers to data from World Bank’s 2014 ‘Ease of Doing Business’ report and World Economic Forum’s Global Competitiveness 2013 – 2014 as well as 2014 Global Enabling Trade reports. It measures five indicators, namely company incorporation, corporate tax rate, foreign investment friendliness, intellectual property protection and workforce.

Overview

Popularly denoted as the ‘factory of the world’, China offers huge economies of scale and low cost labor. However, when it comes to diminishing bureaucratic and legal hurdles for entrepreneurs, Singapore performs better than the ‘Land of Red Dragon’.

Singapore holds the top position in the world for ease of doing business according to the World Bank’s Doing Business 2014 report – a joint publication and a project by World Bank and International Finance Corporation. China, on the other hand, stands at 96th position.

China presents regulatory and bureaucratic hurdles to foreign investment and the inherent advantages of low-cost-labor too seem to be fading as Africa becomes more cost-attractive. Singapore, the tiny city-state located in the center of South East Asia, offers numerous advantages to foreign businesses looking to expand their businesses in Asia and beyond.

| World Bank’s Doing Business (DB) 2014 Singapore vs. China |

||

| Rank | ||

| Measure | Singapore | China |

| Overall ranking | 1 | 96 |

| Starting a business | 3 | 158 |

| Dealing with construction permits | 3 | 185 |

| Getting electricity | 6 | 119 |

| Registering property | 28 | 48 |

| Getting credit | 3 | 73 |

| Protecting investors | 2 | 98 |

| Paying taxes | 5 | 120 |

| Trading across borders | 1 | 74 |

| Enforcing contracts | 12 | 19 |

| Resolving insolvency | 4 | 78 |

Company incorporation

Traditionally, China has provided low-cost manufacturing solutions for the global market, but exports declined sharply after the global downturn leading to a slower economic growth. The regulatory landscape still presents a challenge for foreign investors.

The different markets, geographies and industries within China are diverse and local regulations and enforcements of central regulations differ greatly in various regions. Further China has been losing the ‘low-cost-labor’ advantage due to the slowing demographic growth and rise in wages.

Starting a business in Singapore is more convenient than in China. Singapore offers a better deal in terms of the procedures, time and cost involved in launching a commercial or industrial firm. It takes only 1-2 days to incorporate a company in Singapore with minimum procedures and a near absence of bureaucracy.

In contrast, it takes more than a month to incorporate a firm in China. According to the Doing Business report, Singapore ranks 3rd in terms of starting a business – putting it ahead of China, which ranks 158th.

China faces systemic challenges which include an unbalanced industrial sector, resource and environmental constraints, development gaps between rural and urban areas, bureaucracy and corruption and barriers that stand in the way of promoting development in a scientific manner.

Singapore on the other hand offers a business environment more open and conducive to innovation and growth with lesser regulations. The excellent infrastructure coupled with seamless network connectivity makes it the ideal destination for global business.

Corporate tax rate

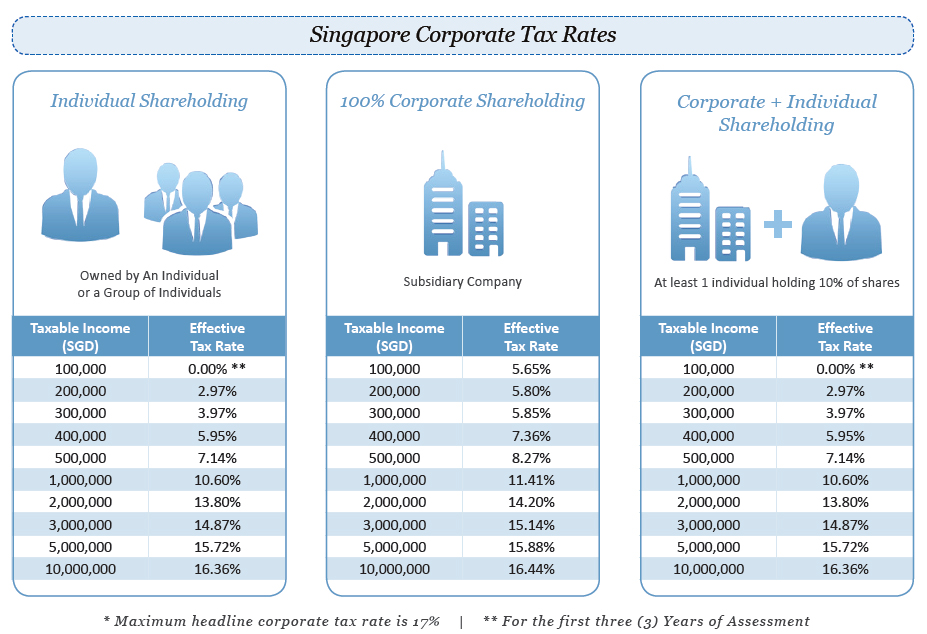

The corporate tax rate in Singapore is capped at 17%, while the standard corporate tax rate in China stands at 25%. In the ‘Doing Business 2014’ report World Bank ranked Singapore second for its lower tax rates and efficient tax filing procedures.

China was ranked 120th, far behind Singapore, on the same parameter. Similarly the ‘2014 Paying Taxes Report’, compiled by PWC, IFC and World Bank, reveals that Singapore is the fifth easiest place in the world for paying taxes.

China on the other hand was ranked 120th in terms of ease of paying taxes. According to the ‘Paying Taxes Report’, Singapore tops the position as it has only one core tax, requires a low number of hours to comply and has a highly competitive total tax rate.

Singapore’s corporate tax rates under the SUTE scheme

To qualify for full tax exemption, the following conditions must be met by companies:

- Registered in Singapore

- Tax resident in Singapore for the YA

- Has no more than 20 shareholders during the YA where

- All shareholders are individuals holding shares in their own names OR

- At least 1 shareholder is an individual holding at least 10% of the company’s ordinary shares

- Investment holding companies and companies engaged in property development activities are entitle to partial exemption only.

China’s corporate tax rates

Paying taxes in China, per the World Bank 2014 Doing Business report

| Tax or mandatory contribution |

Payments (number) |

Total tax rate (% profit) |

| Employer paid – Social security and housing fund contributions | 1 | 49.6 |

| Corporate income tax | 1 | 5.7 |

| Urban maintenance tax | 0 | 3.5 |

| Education surcharge | 0 | 1.5 |

| Real estate tax | 1 | 1 |

| Stamp duty | 1 | 1 |

| Business tax | 1 | 0.5 |

| Levies for construction and maintenance of river projects | 0 | 0.5 |

| Land use tax | 1 | 0.4 |

| Value added tax (VAT) | 1 | – |

| Total | 63.7 |

Foreign investment friendliness

Singapore government offers numerous incentives for foreign businesses to set their shop in the city-state. Singapore supports an open trade policy and there are very few barriers to external trade transactions. The 2014 Global Enabling Trade report ranked Singapore at the top position due to its trade friendly regulations and a business enabling environment. China stood at the 54th place.

In the report, burdensome import and export procedures, delays caused by international transportation and high tariffs were cited as the prohibitive factors for businesses in China. Singapore, on the other hand, offers excellent roads, railways, ports and air infrastructure with fast and standard procedures pertaining to import and export.

Intellectual property protection

Protection of Intellectual Property (IP) rights is a crucial element responsible for gaining confidence of foreign investors. According to the World Economic Forum’s Global Competitiveness Report 2013-2014, Singapore stands second in the world and first in Asia for having the best IP protection.

The Global Competitiveness Index (GCI) ranks China at 53rd position. The report assesses the strength of the IP protection measures, including anti-counterfeiting measures.

| WEF’s Global Competitiveness Index (GCI) Singapore vs. China |

||

| Rank | ||

| Measure | Singapore | China |

| Overall ranking | 2 | 29 |

| Basic Requirements (60%) | 1 | 31 |

| Institutions | 3 | 47 |

| Infrastructure | 2 | 48 |

| Macroeconomic environment | 18 | 10 |

| Health and primary education | 2 | 40 |

| Efficiency Enhancers (35%) | 2 | 31 |

| Higher education and training | 2 | 70 |

| Goods market efficiency | 1 | 61 |

| Labor market efficiency | 1 | 34 |

| Financial market development | 2 | 54 |

| Technological readiness | 7 | 85 |

| Market size | 34 | 2 |

| Innovation and sophistication factors (5%) | 13 | 34 |

| Business sophistication | 7 | 45 |

| Innovation | 9 | 32 |

Workforce

Singapore offers flexible immigration policies and greater clarity on employing foreign workers. Singapore provides access to a highly educated and skilled workforce and getting expat talent is much easier in Singapore compared to China. Furthermore, China presents a language barrier and does not feature a large English-speaking workforce.

In contrast, Singapore’s workforce is completely conversant with English. GCI ranked Singapore at the top position for excellent ‘Labor Market Efficiency’. GCI ranked China 34th for the same measure.

In a Nutshell

China has earned the label “factory of the world” by offering huge economies of scale and vast low-cost labour force. However, bureaucratic hurdles, corruption in government agencies, and legal obstacles for entrepreneurs have diminished the country’s attractiveness in recent decades. Singapore, on the other hand, still retains its business-friendly image due to ease of company incorporation, low corporate tax rates, foreign investment friendliness, intellectual property protection, and corruption-free bureaucracy, among others.

Read More » Press Release on China vs. Singapore Comparative Report

Incorporate a company in Singapore quickly and easily

Singapore Company Incorporation is the leading force in company registration in Singapore. With a gamut of services including Work Visas & Relocation, Accounting & Taxation, Business Licenses, Company Secretary and Trademark Registration, we are well-positioned to support your business.