In this article

With few natural resources to depend on, Singapore’s economic success is largely attributed to its extensive trade networks and government initiatives.

These factors have made it extremely attractive for companies to set up in Singapore, regardless of whether they are multinational corporations (MNCs) or budding entrepreneurs. Below is the complete guide on Singapore company incorporation.

A Guide to Singapore Incorporation

Notably, Singapore was ranked second in the World Bank’s annual survey of 189 economies on the Ease of Doing Business 2021.

The World Bank’s annual survey considered the administrative burden of the tax system, the ease of obtaining utilities, and the number of procedures to be completed before a company can be incorporated.

What are the Requirements for Incorporating in Singapore

Before incorporating a company in Singapore, the business owners should first decide on several things and ensure that certain items are prepared prior to incorporation, namely:

Before incorporating a company in Singapore, the business owners should first decide on several things and ensure that certain items are prepared prior to incorporation, namely:

- Company’s desired name

- The company’s principal activities (the company can select up to a maximum of two)

- Company’s directors

- Company’s shareholders

- Registered office

- Company secretary

- Share capital

- Singpass

Pre-Incorporation Criteria for ACRA Registration

If you want to apply to the Company Registrar of Singapore (ACRA), you will need to prepare for the following incorporation requirements.

- At least one (1) shareholder

- A minimum initial paid-up capital of S$1

- At least one (1) Company Secretary

- At least one (1) Local or Resident Director

- A local registered address for the company office

Company’s desired name

There are several general guidelines that business owners should generally observe when selecting a name for their company, such as:

- Ensuring that there are no words that can be construed as vulgar or inappropriate;

- Usage of national symbols, such as “Merlion”

In addition, certain industries that are overseen by governing bodies due to the nature of their business, such as the provision of medical services, may need approval or referral from the governing authority or society before they can proceed with reservation of the business name.

A comprehensive list of the relevant governing bodies is set out in the table below:

Governing Body |

When it may be required* |

|---|---|

Board of Architects (BOA) Singapore |

The use of the word “architect” in a name or business designation |

Council for Estate Agencies (CEA) |

Principal activities involving “Real Estate Agent” or “Real Estate Agency” |

Enterprise Singapore (ESG) |

Names and activities involving “rubber” and/or “spot commodity trading” |

Ministry of Culture, Community and Youth (MCCY) – Charities Unit |

Names for registered charities with “Foundation”, “International” or “Singapore” |

Ministry of Defence (MINDEF) – Defence Industry & Systems Office (DISO) |

Names with “Military” or “Defence” |

Ministry of Education (MOE) – Private Schools Section |

Names with “Academy”, “College”, “Institute”, “Institution”, “University”; and “National”, “Singapore”, are usually disallowed |

Ministry of Foreign Affairs (MFA) – ASEAN National Secretariat, Singapore |

Names with “Association of Southeast Asian Nations” or “ASEAN” |

Ministry of Law (MinLaw) – Legal Services Regulatory Authority (LSRA) |

Names with Law-related words or acronyms like “Law”, “Legal”, “Counsel”, “Chamber”, “Advocate”, “Solicitor”, “Law Corporation”, or “LLC” |

Monetary Authority of Singapore(MAS) |

Names with “Bank” and its derivatives, “Finance Company” and “Finance”, “Futures Exchange”, “Clearing House” and “Securities Exchange” or titles that are similar to these titles |

Professional Engineers Board (PEB) |

Names with “Professional Engineering”, “Professional Engineers” and “PE” |

Singapore Tourism Board (STB) |

Where there is usage of STB’s name and the Merlion symbol |

SkillsFuture Singapore (SSG) |

Names with “SkillsFuture” will typically be disallowed |

Institute of Singapore Chartered Accountants (ISCA) |

Names and activities containing “Accountancy”, “Accounting”, “Audit”, or derivatives thereof |

Ministry of Health (MOH) |

Names and activities containing “hospital”, “medical clinic/centre”, “dental clinic/centre”, “surgery”, “medical/clinical laboratory”, “healthcare establishment” or any other term or name that implies similarity to these terms |

Registry of Co-operative Societies |

Names and activities containing “Co-op” or “Co-operative” |

(The table above is extracted from ACRA: List of Referral Authorities)

*Approval is granted at the discretion of the Accounting and Corporate Regulatory Authority (“ACRA”) as well as the relevant government body. For the avoidance of doubt, companies should undertake the responsibility of checking with the relevant government body.

In addition, you may check the availability of a company name using our free Company Name Check Tool.

Principal Activities

It is also important to decide the principal activities for any Singapore company registration.

The company’s principal activities can be chosen from the list set out in the Singapore Standard Industrial Classification (“SSIC”). This is also known as the company’s SSIC code.

Similar to the company’s chosen business name, if the company chooses certain business activities that are regulated, the company’s name application may be forwarded to the relevant governing body for its consideration.

Company’s directors and shareholders

With regards to the particulars of directors and shareholders, companies should note that it is a requirement that at least one director be locally resident in Singapore. Similarly, the company’s registered office should also be based in Singapore.

The local director should fulfill the prescribed criteria that are stipulated in the Companies’ Act, namely that he or she:

- Is a natural person of sound mind over 18 years of age (i.e. corporations cannot be a director)

- Is not an undischarged bankrupt by a Singapore Court or a foreign court

- Is not an unfit director of an insolvent company

- Is not a director of a company that was wound up on grounds of national security or interest

- Has not been convicted of any offence involving fraud or dishonesty

- Has not been convicted in Singapore of any offence in connection with the formation or management of a corporation

- Has not been adjudged guilty of three or more offences within the last five years in relation to the requirements of the Companies Act

- Is not subject to a disqualification order under section 34, 35, 36 of the Limited Liability Partnerships Act

It has been the norm that directors and shareholders have to disclose their personal details, such as their residential address, as part of the incorporation process. This information would then be made available for purchase by the public when they purchase the Business Profile (also known as Certificate of Incumbency in various other jurisdictions) from the Accounting and Corporate Regulatory Authority (“ACRA”).

It has been the norm that directors and shareholders have to disclose their personal details, such as their residential address, as part of the incorporation process. This information would then be made available for purchase by the public when they purchase the Business Profile (also known as Certificate of Incumbency in various other jurisdictions) from the Accounting and Corporate Regulatory Authority (“ACRA”).

Recognising the need for privacy, ACRA has now introduced the option of the use of an alternate address for each individual. However, the use of this option is limited by the following conditions:

- The alternate address cannot be a P.O. Box

- Should be in the same jurisdiction as the individual’s residential address

- The individual must still provide his or her residential address to ACRA

ACRA takes the provision of false information seriously, and any individual found to have provided a false address will result in ACRA barring the said individual from using the alternate address for the next three years. Hence, companies are advised to be cautious and meticulous when filling out their applications.

Registered Office

The company’s registered office should fulfill the following criteria:-

- Open for at least five hours during ordinary business hours on each business day

- It should be a physical office address located in Singapore

- It cannot be a P.O. Box

There are several options that companies can choose when establishing a registered office in Singapore, such as:

- Renting an office space

- Opting for a virtual office

- Applying for a license to have a home office

If the company does not need to be incorporated urgently, it could consider options (A) and (C). Option (C) in particular, is a relatively lengthy process.

It may also be rejected by the Housing Development Board (“HDB”) or Urban Redevelopment Authority (“URA”) as residential areas may not be deemed suitable for business operations; or other related factors. Option (B) on the other hand, can be set up in a matter of minutes.

Cost-wise, option (C) would be the cheapest as it does not require the rent payment. However, administratively, option (B) may make the most sense for most companies as virtual offices often provide complimentary business services.

These services include receptionist services, mail scanning, and forwarding offices; and even provide professional corporate meeting rooms decked out with teleconferencing and video conferencing facilities.

Company Secretary

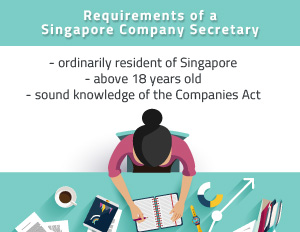

Under the Companies’ Act, all companies are required to appoint a company secretary within six months from the date of incorporation. The company secretary (who is also considered an officer of a company) assists in the administration of a company.

Under the Companies’ Act, all companies are required to appoint a company secretary within six months from the date of incorporation. The company secretary (who is also considered an officer of a company) assists in the administration of a company.

For example, they ensure that directors and shareholders are kept well informed of statutory obligations, such as the annual filing of audited accounts and the holding of annual general meetings (AGM).

If the company only has a sole director, he or she cannot also fulfill the role of a company secretary.

Related Read: How Has the Role of the Company Secretary Evolved?

Share Capital

Unlike certain foreign jurisdictions, Singapore has a very low minimum requirement for issued and paid-up share capital of S$1. Companies are not required to produce evidence that the minimum share capital is in a bank account either.

Hence, the setting up of the company’s corporate bank account can be done at a later stage, post-incorporation.

Singpass

Last but not least, in order for the company to submit the incorporation application to ACRA. A Singpass is an electronic identity that is provided to all Singapore citizens, while foreigners with qualifying FINs can also apply for a Singpass.

With the Singpass, an individual can then lodge the incorporation application to ACRA via its electronic portal known as Bizfile.

With the Singpass, an individual can then lodge the incorporation application to ACRA via its electronic portal known as Bizfile.

SCI is Here to Help

Given the various administrative steps provided, it would be prudent for companies to seek a professional corporate service provider’s help when incorporating a company.

This is because an experienced corporate service provider such as SCI can highlight areas of concern that may be unique to the company’s businesses and assist with liaising with the government bodies if there are any issues to be resolved.

Contact us today to find out more!

FAQs

Incorporate a company in Singapore quickly and easily

SCI is here to guide you through the entire Singapore company incorporation process.